From Storage to Suite: Converting a Basement Into a Walkout Rental

Converting your basement into a rental unit requires more than a simple basement remodel.

Your unused basement could generate $14,400 each year as an income suite and turn that dormant space into a profitable rental property. The original investment might seem high at around $50,000, but many homeowners recover these costs within five years through steady rental income.

The potential returns make it an attractive investment, as a fully converted basement apartment could bring in $1,200 or more monthly. This piece will guide you through everything you need to convert your basement into a profitable rental space, whether you want to offset mortgage payments or create a steady passive income stream

Assessing Your Basement's Rental Potential

Starting a basement conversion to create a profitable income suite needs a full picture of your space’s potential. Your original task involves checking structural problems that might affect your investment. Foundation cracks, bowing walls, or uneven floors might signal serious problems needing quick fixes.

Moisture control stands as the key factor for any basement apartment. High humidity and water seepage can create mold, musty smells, and damage the structure. Getting professional basement inspections helps spot these problems before repairs get pricey. Good damp proofing and waterproofing are the foundations of success, since wet basements can drop property values by 10-20%.

A review of legal requirements comes next. Local rules often specify these requirements for basement apartments:

- Minimum ceiling height (typically 7 feet)

- Egress windows in every bedroom (minimum 5.7 square feet opening)

- Separate entrance to ensure tenant privacy and safety

- Certificate of Occupancy or equivalent permits

Local zoning laws need checking since basement apartments aren’t allowed everywhere. On top of that, some areas require owners to live in the property if they rent out the basement.

The potential returns show that basement apartments can generate monthly rental income equal to 1% of your property’s purchase price after repairs. Most properties deliver returns between 4-10% yearly. Note that ongoing costs like maintenance, repairs, and possible vacant periods affect your profit estimates.

A full basement conversion into a rental unit costs between $50,000-$75,000. Notwithstanding that, Remodeling’s Cost vs. Value report shows homeowners recover about 70% of these costs in added property value. This makes it a solid investment beyond just rental income potential.

Safety and Legal Requirements

Your basement’s transformation into a rental suite needs several key construction elements. The right insulation stands as the foundation of an energy-efficient and moisture-controlled space. Closed-cell spray foam insulation works best because it fills every gap and creates a tight, moisture-resistant seal that blocks airflow between floors.

Safety and legal requirements demand proper egress windows. The specifications are clear – windows must measure 5.7 square feet, with dimensions of 20 inches wide by 24 inches high. The window sill should sit no higher than 44 inches from the floor. Basement windows need extra space – at least 36 inches in both width and height. Window wells must provide enough clearance for easy escape.

A separate entrance will boost tenant privacy and your property’s value. The project costs range from $2,500 to $10,000 based on how much excavation you need and your foundation’s current setup. Your plans should include stairs with proper drainage and weatherproofing to keep water out.

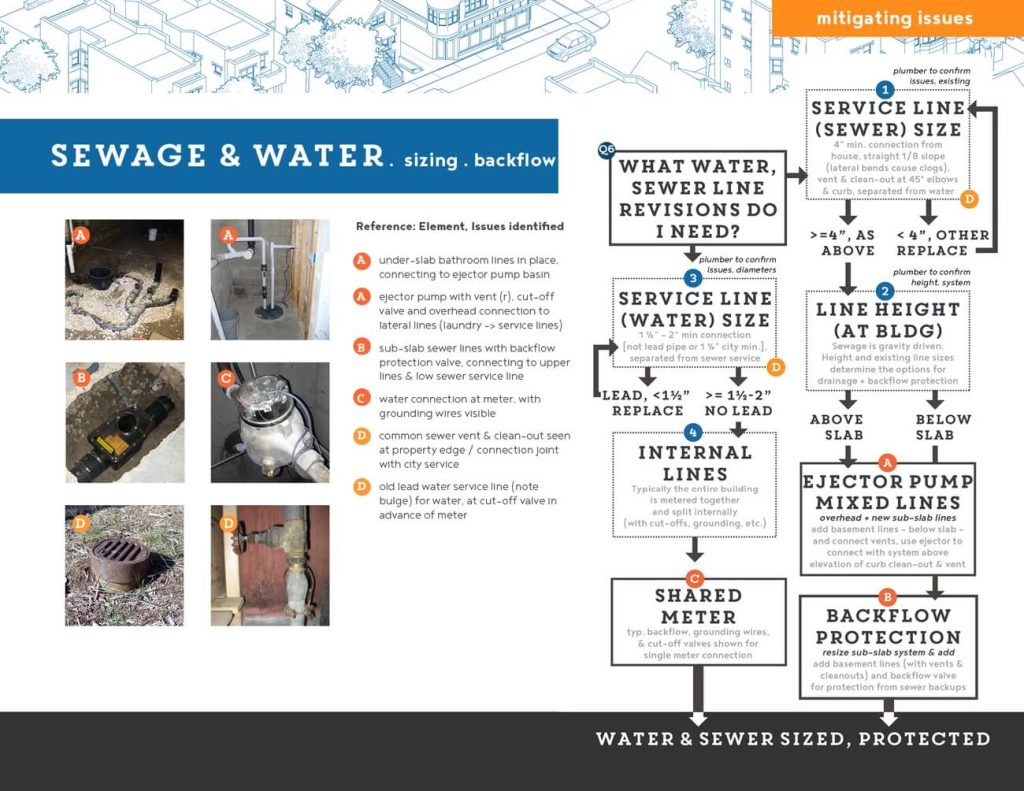

The plumbing setup needs smart planning. A sewage ejector system becomes necessary if your main waste line sits above the foundation level. Your bathroom needs proper ventilation too. Outside-venting exhaust fans help prevent moisture and mold problems.

The electrical system needs careful attention. While most homes run on 100 amps, a new unit might push you to upgrade to 200 amps. Separate electrical panels and meters let tenants handle their own power bills.

Your HVAC system‘s capacity needs evaluation before adding more space. Ductless mini-split systems make a great choice since they skip extensive ductwork and give tenants control over their temperature.

Sound control between floors is vital for everyone’s comfort. Here’s what works best:

- Acoustic panels on ceilings

- Extra layers of drywall for mass

- Resilient channels that stop sound vibrations

These steps need thorough planning and professional help to create a basement suite that’s safe, comfortable, and meets all local building codes.

Budgeting and Financial Planning

Turning your basement into an income suite is a major financial investment that needs proper planning. The national average cost to finish a basement runs from $10,000 to $35,000. A dedicated rental space with separate amenities can push costs between $30,000 and $75,000. Most homeowners spend about $50,000 for a complete basement apartment conversion.

You need to know your financing options to make your project successful. Home equity loans let you borrow up to 85% of your home’s equity with payback periods between five and 30 years. A Home Equity Line of Credit (HELOC) gives you flexible access to funds, but variable interest rates might change your payments. Personal loans can provide up to $100,000 based on your credit score if you don’t have enough equity.

The numbers need to make sense before you start. Well-done basement projects usually return 60-75% of their cost in added property value. Rental properties should target annual ROI between 6-10%. You can figure this out by taking your yearly rental income, subtracting property expenses, adding equity growth, and dividing by your total investment.

Tax implications need careful attention when you create an income suite. The IRS requires you to report rental income, but you can deduct several expenses:

- Mortgage interest on the rental portion of your property

- Insurance premiums associated with the rental

- Maintenance and repair costs

- Depreciation on the portion of your home that’s rented

The tax authorities might see this as a “change in use” with capital gains implications when you convert part of your main home into a rental. You should talk to a tax professional before starting your project to avoid surprises later.

Energy-saving upgrades during your remodel could qualify for extra tax benefits. These improvements can lower your tenant’s utility costs and make your rental more appealing in a competitive market.

A basement rental suite conversion offers a rewarding investment chance. The upfront costs typically range between $50,000-$75,000, but smart planning can lead to great returns through rental income and your property’s increased value.

Steady rental income can help many homeowners recoup their investment within five years, making basement conversions a practical path to passive income. However, success depends on thoughtful planning, professional guidance, and attention to detail throughout the process.

With the right approach, your basement can become a valuable asset—one that not only generates monthly income but also enhances your property’s overall value. A well-executed remodel can transform an underused space into a profitable rental suite that benefits both you and your future tenants.

Leave a Reply

You must be logged in to post a comment.